What do you need to know

First, you need to determine if you are providing a service that will be regulated by AUSTRAC under the reforms.

The new designated services that will be regulated in 2026, often referred to as Tranche 2 services, are commonly provided by accountants, lawyers and other professional service providers, including financial advisers.

Some examples of the new designated services include:

- assist, plan or execute a transaction to buy, sell or transfer a legal arrangement or body corporate

- appoint directors, company secretaries or powers of attorney for a legal arrangement or body corporate

- handle a person’s money, accounts, securities, virtual assets or other property to help a person to plan or execute a transaction, and

- provide a registered post office address or principal place of residence for a client.

Importantly, a ‘legal arrangement’ includes express trusts, partnerships, joint ventures and unincorporated associations, and any similar arrangement.

As you can see from the examples, the broad terms used will cast a wide net over the future services that will be regulated.

If you determine that you are providing one or more of the new designated services, and you are not currently enrolled as a reporting entity with AUSTRAC, you will need to enrol and comply with the AML/CTF regime by 1 July 2026.

If you are an AFS licensee, the current item 54 exemption has been retained. However, if you provide any other designated service in addition to an item 54 service, you will need to comply with all AML/CTF obligations.

You can use the AUSTRAC ‘Check if you’ll be regulated’ tool to see if you or your business may be regulated.

What do you need to do

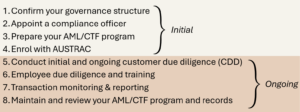

If you need to comply with the AML/CTF regime, the steps you need to can be broken into initial and ongoing actions:

AUSTRAC still need to finalise the AML/CTF Rules, which provide more detailed information on your specific obligations and importantly, have the backing of law. Without the AML/CTF Rules, it is not possible to prepare a compliant AML/CTF Program.

We anticipate the AML/CTF Rules will be finalised late July and AUSTRAC will issue core guidance in September.

In the interim, you can start working on the following decisions and actions.

Confirm your governance structure

The AML/CTF Act requires you to have the following roles and responsibilities in place:

- Governing Body – responsibilities include overseeing and ensuring compliance with the ML/TF risk assessment, AML/CTF policies, AML/CTF Act and Rules

- Senior Manager – responsibilities include approving the AML/CTF Program, including any amendments, and

- AML/CTF Compliance Officer – responsibilities including day to day compliance and communicating with AUSTRAC.

Importantly, if you are a sole practitioner or a small business the distinction between these roles may not be relevant, however the responsibilities and tasks remain the same. It also means if you are a small business, you do not need to hire someone to be your full time AML/CTF Compliance Officer.

When do you need to action it by

To help you plan and be ready for 1 July 2026, we have prepared the following timeline and recommended action plan.

Sign up to our AML/CTF updates & receive a free ‘Getting Ready’ Workbook:

| Sign up |